Do I Need Business Interruption Insurance?

4/19/2020 (Permalink)

Your commercial insurance policy will pay for damages to your physical property in Wyncote, PA while you are recovering from a disaster, such as a business fire. If you have to stop business operations temporarily or relocate while renovations take place, however, your basic policy won’t cover any of the business interruption costs. You should talk with your insurance agent about the need for an additional business income insurance policy.

What Does Business Income Insurance Cover?

This interruption policy can be added to your basic coverage to help you recoup the revenue lost during the business downtime. It’s specifically designed to help a business maintain the same financial position it had before the fire. The following are items typically covered under this additional policy:

Profits - Your agent will look at your financial statements from several previous months to determine how much profit could have been earned during the downtime.

Fixed costs - This includes operating expenses, such as payroll, building rent or mortgage payments, utilities and other costs to run operations.

Extra expenses - Any additional costs will be covered, within reason, if needed for the business operations to continue while the fire cleaning takes place.

Temporary relocation costs - Moving expenses, including rent for a temporary location, can be covered under specific policies.

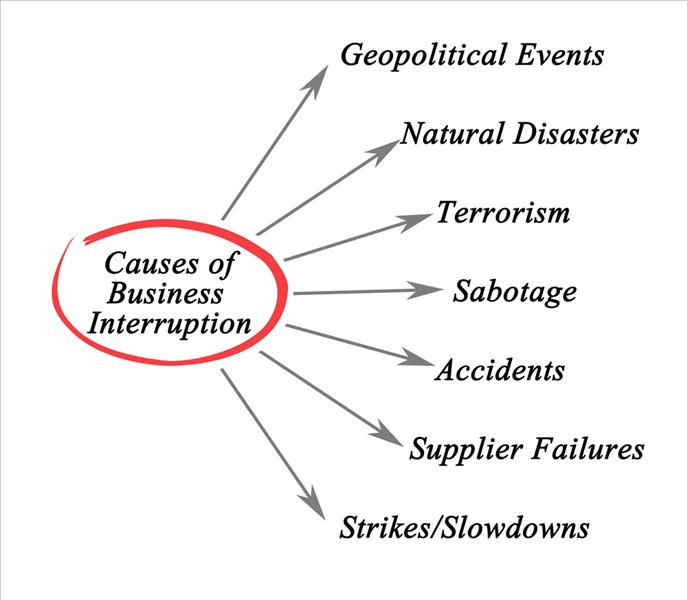

There is an additional policy that can be purchased to cover your business, called contingent business interruption insurance. If one of your key suppliers has suffered building damage due to an event, such as a natural disaster, and can no longer supply to you, your lost revenues can be recouped.

It’s best to talk with your insurance agent about all of the options available so that you make the right choice for your business. While it may seem unnecessary to purchase business interruption insurance for your property, not having it when you need it most can be devastating to your business.

24/7 Emergency Service

24/7 Emergency Service